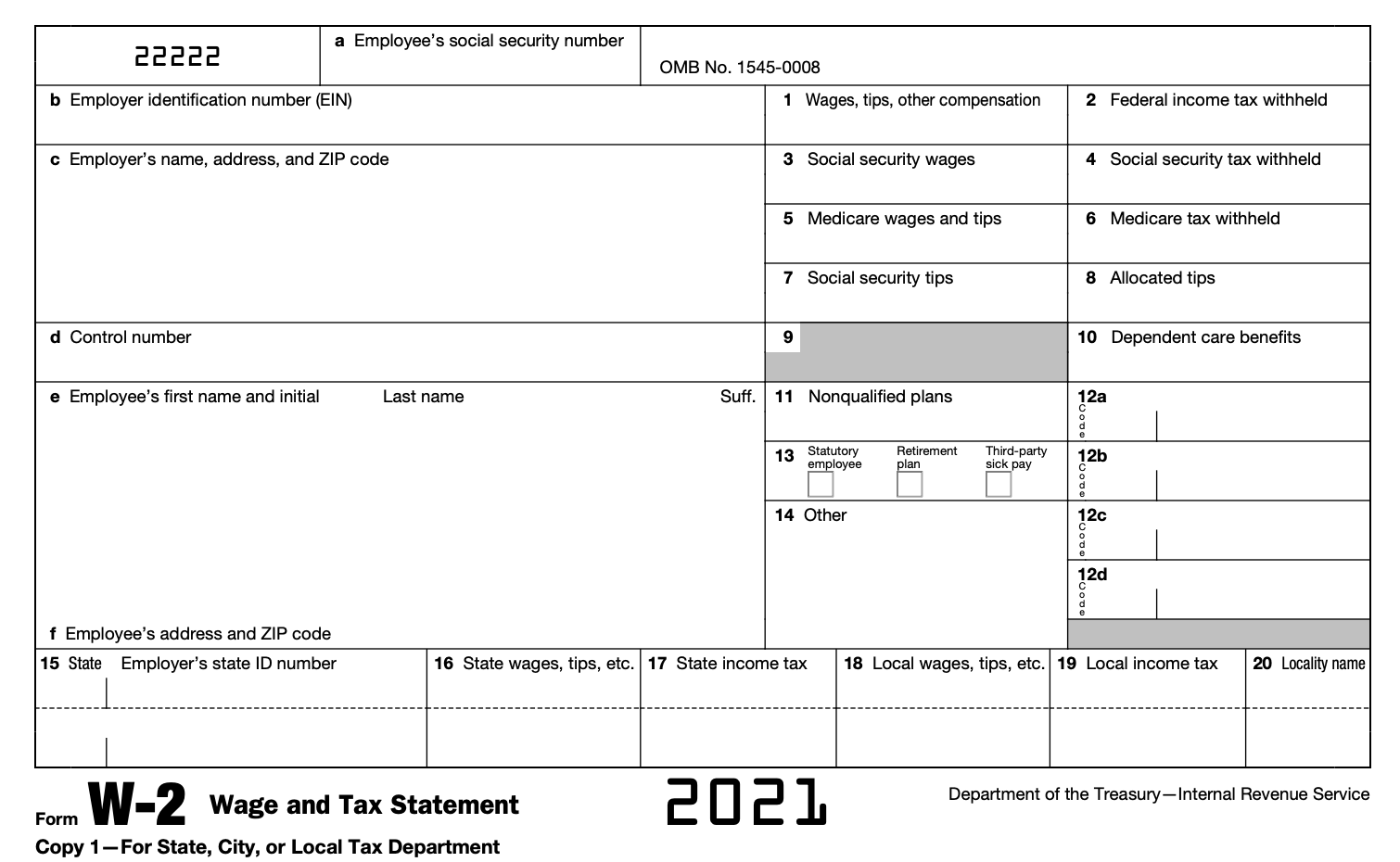

This box shows your agency's payroll number and payroll distribution code to assist in the distribution of W-2s. This is your employer's information for tax reporting purposes. Box c: Employer's name, address, and ZIP code This is the Employer Identification Number assigned by the IRS to The City of New York, Department of Education, City University of New York, New York City Housing Authority, or New York City Municipal Water Finance Authority. Box b: Employer identification number (EIN) OPA will verify your information with the Social Security Administration and then issue a corrected W-2. The Personnel Office will forward a copy of your social security card to OPA along with a W-2 Duplicate Request Form or a W-2 Correction Request Form. If your SSN is incorrect, present your social security card to your Personnel Office immediately. The Social Security Administration uses your SSN to record your earnings for future social security and Medicare benefits. The IRS uses your social security number (SSN) to verify the data it receives from the City against the amounts shown on your tax returns. Box a: Employee's social security number The City sends wage and tax information to the Social Security Administration and the New York State Department of Taxation and Finance. Copy B - attach it to your federal tax return.Copy A - attach it to your state and city or other local tax return.This is the calendar year covered by the W-2. Your W-2 Wage and Tax Statement itemizes your total annual wages and the amount of taxes withheld from your paycheck. The W-2 form is a United States federal wage and tax statement that an employer must give to each employee and also send to the Social Security Administration (SSA) every year.

0 kommentar(er)

0 kommentar(er)